CXTech Landscape Across Asia by Alan Quayle, with the support of hundreds of people across CXTech

We’re entering a new phase in the democratization of telecoms. Communications is now programmable, revolutionizing the $2.2T telecoms industry. Enterprises large and small, governments, local businesses, hospitals, dentists, web companies, garden centers are all using communications in new ways to improve their operations and customers’ experiences. There are hundreds of companies around the world that are helping businesses use programmable telecoms.

The aim of this session is to provide an open, independent, and industry-wide review of the impact of programmable telecoms on business. We will cover CPaaS (Communications Platform as a Service), UCaaS (Unified Communications Platform as a Service, AKA virtual or cloud PBX), CCaaS (Contact Center as a Service), open source telecom software, authentication and customer experience, omni-channel customer communications, WebRTC (Web Real Time Communications) and much more reviewing the landscape and market sizes.

This is an update to the CXTech Landscape presentations given at TADSummit Americas and TADSummit EMEA in Oct and Nov 2019 respectively.

The main updated include:

- Added another 200+ companies (bottoms-up analysis)

- Expanded list of global VoIP providers and CXTech companies

- Expanded list of master agents and distributors (mainly North America, international TBC)

- Added channel and telco contributions to the revenues

- Updated projections to include global recession for H2 2020 and H1 2021.

- Most collaboration providers are not impacted – slight acceleration for some

- Call center is initially not impacted, slight downturn in H1 2021

- Usage based businesses impacted in H2 2020, e.g. CPaaS.

- Will update downturn model as company results get announced through 2020.

- Added regionalization of revenues (simple Americas, EMEA, Asia split)

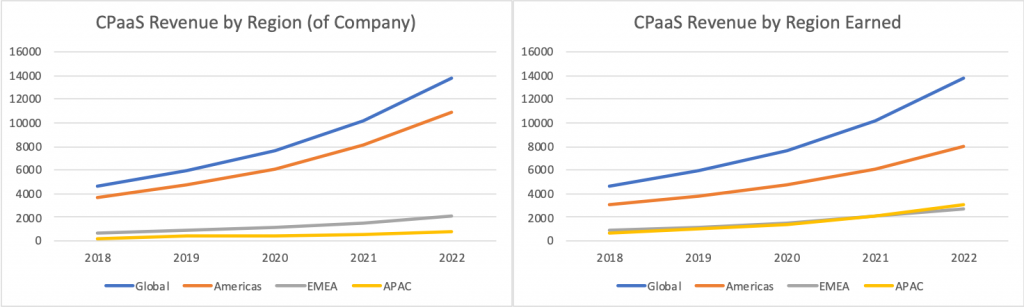

Below I show the gap for Asia on CXTech earnings for CPaaS. In the presentation you can also see the gap for enterprise VoIP, particularly for innovative smaller providers. Put simply, revenue earned in Asia is going to North America.

What is the cause of this gap?

- Talent is everywhere – so that’s not an excuse;

- CPaaS is no longer that interesting to VCs – so conservative Asian VCs in not an excuse;

- Open Source will commoditize CPaaS (Wazo and Drachtio) – so technology barrier is not an excuse, though adoption of open source telecom software is lower in Asia than in other regions; and

- Perception in Asia that I do not see in Western markets that “telcos still own telecoms”.

The latter point is at least partially responsible for the gap. I faced it in putting TADSummit Asia together last year. The event was perceived as a telco event, while CXTech impacts anyone involved in communications across any industry.

Hence why for TADSummit Asia 2020 we’re trying to help close the gap through:

- Encourage the Rise of Open Source Telecom Software across Asia

- Open Source Telecom Software Landscape

- Sessions from Asterisk, freePBX, Kamailio, OpenSIPS, and dratchio

- The Universal Telecom API in Asia

- An evolutionary outlook on the role of IT, by Sebastian Schumann, Technology & Innovation at Deutsche Telekom

- Improving the Experience of Realizing CXTech Use Cases, by Marten Schoenherr, CEO/Founder at Automat Berlin GmbH

- Panel discussion including:

- Mark White, Tech M&A, Investor, Founder, Board Member, Startup.

- Craig Richards, Vice President, Products and Engineering at Apigate

- Dinesh Saparamadu, Founder of Applova Inc., hSenid Group of Companies & PeoplesHR | Entrepreneur | HR & Mobile Industry Thought Leader

- Lots of programmable communications innovator interviews from across Asia, and an interview with David Curran from Dublin on the importance of hackathons.

My hope is TADSummit Asia will help Asian entrepreneurs close the revenue gap in CXTech.

If you have questions or comments, please add them in the comments section of this weblog. Else contact me directly.